Billion dollar brain

Cloud-based accounting software solution provider, Xero, has just been awarded a sizeable R&D grant on top of a recent $4mn investment. ROD DRURY, Xero’s CEO chats to SHARON DAVIS about Xero’s growth and plans.

After establishing and selling several million-dollar businesses, successful serial entrepreneur Rod Drury spotted another gap in the technology market – one that he says has the potential to build a billion-dollar company.

Enter online accounting software firm, Xero, a company Drury co-founded in July 2006 with small business accountant Hamish Edwards.

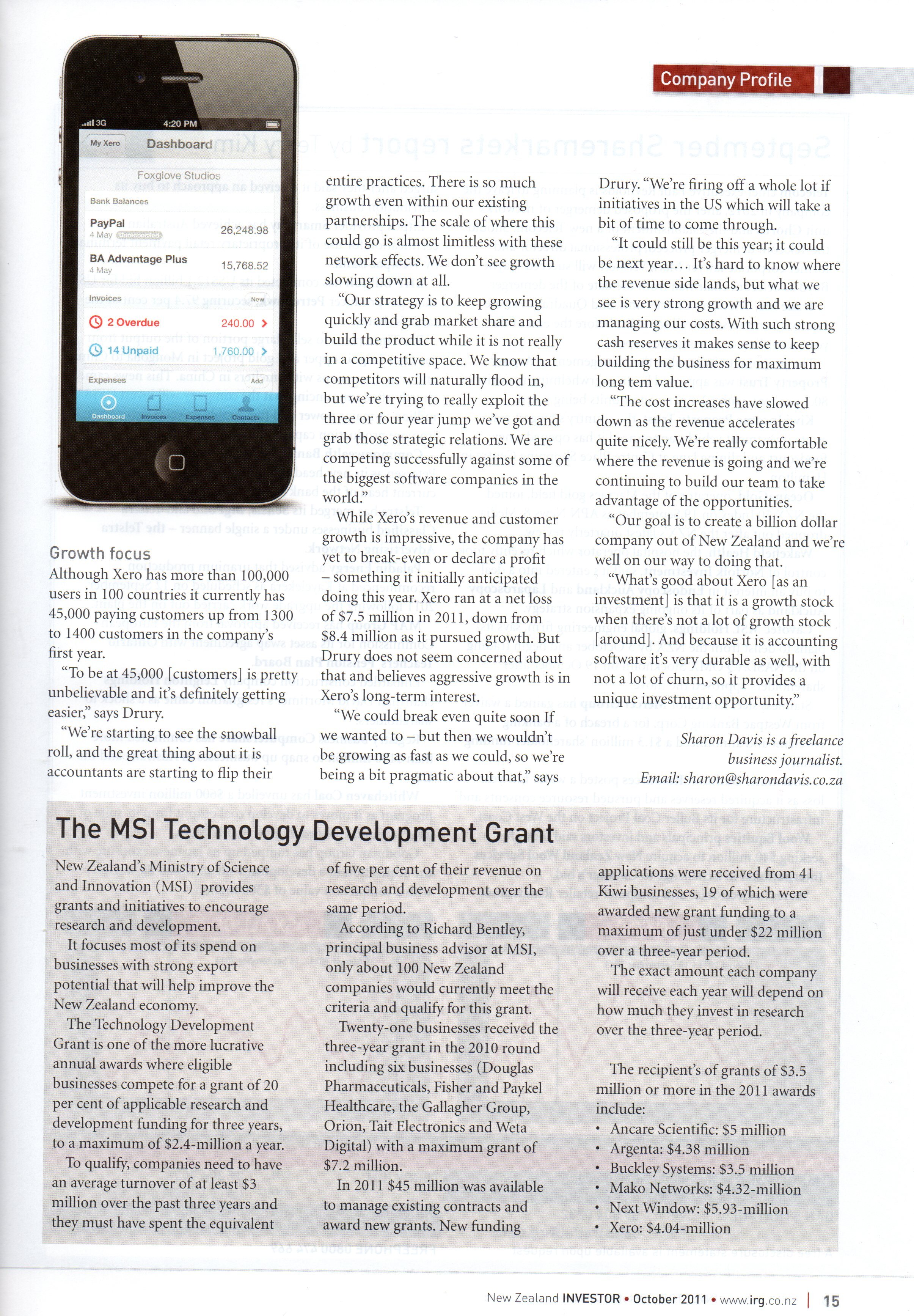

Recognising that the internet had the potential to change the business landscape they set about creating an accounting suite for small businesses on the Software-as-a-Service (Saas) model. The company provides clients with real-time access to invoicing, payments and accounts information.

Drury listed Xero [XRO] on the New Zealand stock exchange (NZX) in June 2007 and since then the accounting technology company seems to be on the superhighway to success.

This past financial year, to the end of March 2011, Xero has tripled revenue to $9mn and is on track to earn $15mn in 2012, with revenue in excess of $1mn a month since February 2011. The technology company has also seen a 25% growth in customers to 45,000 in Q2 and has attracted considerable interest and investment.

Xero has completed three capital raisings. Its initial IPO, a second-round in mid-2009 when Craig Winkler, co-founder of Australian-based rival accounting software provider MYOB, sold his shares in MYOB and invested $18mn in Xero, and now Xero is entering the US with the support of San Francisco-based investor Peter Thiel – the man behind online payment gateway PayPal.

Thiel joined Xero’s US advisory board and invested $4mn through Valar Ventures LP to support Xero’s as it takes on Intuit’s QuickBooks and expands into the substantial US small business market.

Xero’s shares rose sharply from $1.50 a share on the back of this announcement peaking at $3 a share at the end of 2010 before dropping slowly to just above $2 a share in July this year.

US expansion

“It’s really exciting being in San Francisco with those guys behind us. It’s like having a Willy Wonka golden ticket – we can get in to see anybody we need to see.

“Our key goal in the US is building partnerships that can get our brand in front of millions of US businesses. We found it incredibly useful having those guys on our team. It gives us so much credibility when we’re doing business development meetings,” said Drury.

Xero began to develop opportunities in the US market in March 2009 and in May they won two Webbys, international awards for excellence on the internet, and at the beginning of 2010 Xero entered an agreement with US-based finance solutions firm Yodlee connecting Xero with 11,000 financial institutions and other account sources.

Xero has released a US version of their cloud-based software, but the company is still very focused on developing strategic partnerships and the right product fit.

The big thing we are missing is the bill payments solutions for the US, which is quite different from New Zealand – we’re working hard on that, said Drury.

“We‘ve got quite a few US customers and we’re getting a huge amount of interest. We’re seen as the leading online accounting technology provider and what we’ve been busy influencing the influencers.

“We’ve had a number of top people down to New Zealand to do due diligence and they definitely see Xero as the next best thing. From 2012 Xero will be in a position to go full throttle in the US market,” said Drury.

“We had the discipline to stay out of the US for the four or five years we’ve been going, knowing we have a great market share in New Zealand, Australia and the UK. Now, with all that heritage, and a very full product, we arrive very well dressed for the US market and there is massive opportunity.

“When we show people the product they’re saying: ‘Holy cow! You’ve done so much!’ We’re on that last 5% of what we need to do for the US market.”

Xero provides four distinct products: an online client-side accounting platform, an accounts platform for accountants, a complete suite of integrated cloud-based applications for accountants, and personal financial management product. “The completeness of this product family creates a real competitive advantage for us,” explained Drury.

Cloud Xero

“Cloud computing is the biggest technology shift in the small business market in 15 years and it’s proving very compelling to this segment,” says Drury.

“We’re seeing a big vendor flow to entrants who have a pure cloud model and customer ethic of being open and transparent and releasing high-quality software quickly and often. We believe that there going to be a number of new global brands created very quickly,” and Drury expects Xero to be among them.

“What’s different about Xero, from an investor’s perspective, is that we’ve raised money to have the four or five years to research cloud-based accounting solutions properly. While there are a few smaller companies that have dabbled in new accounting products no one else has done the real R&D to build the next generation international online ledger. Most competitors’ models are pretty thin on features,” said Drury.

“We have about a three- or four-year head start. We’ve correctly understood how the cloud has changed the accounting software industry by getting accountants and small business on the same platform, allowing accountants to connect with their customers with very little friction and providing the technology for them to fill the role of being trusted advisors.

“In the mid-term, our primary focus is on winning the US, but we get enquires every day about doing other country-specific versions of Xero as well. The business web has become very interesting with huge investment in business web applications.

“Every day we’re getting interest from US investors wanting to come into Xero because if you look at SaaS, especially small business SaaS, all roads pretty much lead to us.

“Being listed is a big part of it. With our major competitor MYOB sold to private equity, Sage and Intuit are the only other public companies in our space,” said Drury who also sits on the board of the NZX.

R&D grants

On 15th August 2011, Xero was one of 19 New Zealand companies to be awarded a Technology Development Grant from the Ministry of Science and Innovation for up to $4.04mn. “BankLink, one of our big competitors got a grant of $2.1mn in 2010 so we felt we had to apply for it as well,” said Drury.

“We’ve always really believed in R&D as it has given us a sustained competitive advantage. The grant means we can accelerate a whole lot of other projects we are doing as well.”

“Our overseas revenue is climbing and will account for more than 50% of our revenue next year, so we’re definitely earning export dollars and creating lots of jobs – and we believe we offer a good return on investment for the R&D grant.

“We’re also seeing a healthy eco-system being built against the Xero interface, allowing other businesses to sell to the customers we’ve been building up.

“It’s really nice to be building a long-term business and it feels like we’re still at the beginning of the journey. We’ve taken a lot of risk out of the business and plan to build a globally significant company that all New Zealanders can be proud of. We’re already in four countries {New Zealand, Australia, UK and US} and Xero will just continue to grow,” said Drury.

Xero’s shares traded at $2.50 a share on the day the grant was announced, up from $2.40 a share on the previous trading day, and at the time of writing this article is trading at $2.85 a share.

Growth focus

Although Xero has more than 100,000 users in 100 countries it currently has 45,000 paying customers up from 1300 to 1400 customers in their first year.

“To be at 45,000 [customers] is pretty unbelievable and it’s definitely getting easier.

“We’re starting to see the snowball rolling, and the great thing about it is accountants are starting flip their entire practices. There is so much growth even within our existing partnerships. The scale of where this could go is almost limitless with these network effects. We don’t see growth slowing down at all.

“Our strategy is to keep growing quickly and grab market share and build the product while it is not really a competitive space. We know that competitors will naturally flood in, but we’re trying to really exploit the three- or four-year jump we’ve got and grab those strategic relations. We are competing successfully against some of the biggest software companies in the world.”

While Xero’s revenue and customer growth is impressive, the company has yet to break-even or declare a profit –something it initially anticipated doing in 2011.

Xero ran at a net loss of $7.5mn in 2011, down from $8.4mn as it pursued strong growth. But Drury does not seem concerned about that and believes aggressive growth is in Xero’s long-term interest.

“We could break even quite soon If we wanted to – but then we wouldn’t be growing as fast as we could, so we’re being a bit pragmatic about that.

“We’re firing off a whole lot if initiatives in the US which will take a bit of time to come through. It could still be this year; it could be next year… It’s hard to know where the revenue side lands, but what we see is very strong growth and we are managing our costs. With such strong cash reserves it makes sense to keep building the business for maximum long term value.

“The cost increases have slowed down as the revenue accelerates quite nicely. We’re really comfortable where the revenue is going and we’re continuing to build our team to take advantage of the opportunities. Our goal is to create a billion-dollar company out of New Zealand and we’re well on our way to doing that.

“What’s good about Xero [as an investment] is that it is a growth stock when there’s not a lot of growth stock. And because it is accounting software it’s very durable as well, with not a lot of churn, so it provides a unique investment opportunity,” said Drury.

The MSI Technology Development Grant

New Zealand’s recently formed Ministry of Science and Innovation (MSI), an amalgamation of the former Foundation for Research, Science and Technology and the Ministry of Research, Science and Technology, is tasked with driving business and economic growth through science and innovation.

The MSI provides a number of grants and initiatives to encourage research and development – and focuses most of its spend on businesses with strong export potential that has the potential to transform the New Zealand economy.

The Technology Development Grant is one of the more lucrative annual awards where eligible businesses compete for a grant of 20% of applicable research and development funding for three years, to a maximum of $2.4-million a year. To qualify companies need to have an average turnover of at least $3-million over the past three years and they must have spent the equivalent of 5% of their revenue on eligible research and development over the same period. According to Richard Bentley, principal business advisor at MSI, only about 100 New Zealand companies would currently meet the criteria and qualify for this grant.

Twenty-one businesses received the three-year grant in the 2010 round including six businesses (Douglas Pharmaceuticals, Fisher and Paykel Healthcare, the Gallagher Group, Orion, Tait Electronics and Weta Digital) with a maximum grant of $7.20-million.

In 2011 $45-million was available to manage existing contracts and award new grants. New funding applications were received from 41 Kiwi businesses, 19 of which were awarded new grant funding to a maximum of just under $22-million over a three year period. The exact amount each company will receive each year will depend on how much they actually invest in research over the three-year period.

The recipient’s of grants of up to $3.5-million or more in the 2011 awards include:

Ancare Scientific - $5-million

Argenta - $4.38-million

Buckley Systems - $3.5-million

Mako Networks - $4.32-million

Next Window - $5.93-million

Xero - $4.04-million

Contact details:

Email: developmentgrant@msi.govt.nz

This article by Shaz was published in the New Zealand Investor in October 2011.